Managing your finances can feel overwhelming, especially with so many expenses, bills, and investments to keep track of. But what if you could simplify the process without spending a dime? Free personal finance software offers a powerful way to take control of your money, helping you budget, save, and plan for the future all without breaking the bank. Whether you’re looking to get out of debt, save for a big purchase, or simply understand where your money is going each month, these tools are designed to unlock your financial potential. Let’s dive into the top 7 free Personal Finance Software that can help you take charge of your financial journey.

Top 7 Free Personal Finance Software: Unlock Your Financial Potential

1. Mint

Mint is one of the most popular free personal finance software options available today. Created by Intuit, the same company behind TurboTax. Mint offers a comprehensive range of financial tools. It automatically syncs with your bank accounts, credit cards, and investment accounts to provide a real-time view of your financial status. The software categorizes your transactions, allowing you to see where your money is going, and helps you set budgets to manage your spending. Additionally, Mint offers free credit score tracking and alerts you to any unusual account activity, making it a powerful tool for anyone looking to stay on top of their finances.

Key Features:

- Automatic Account Syncing: Real-time updates on your financial situation.

- Budgeting Tools: Create budgets and track spending.

- Credit Score Monitoring: Free credit score tracking with regular updates.

Compatibility:

Mint is compatible with web browsers, iOS, and Android devices.

2. GnuCash

GnuCash is an open-source personal finance software that provides double-entry accounting for personal and small business use. It’s particularly popular among users who appreciate the flexibility and power of open-source software. GnuCash offers features like checkbook-style register functionality, scheduled transactions, and the ability to track stocks, income, and expenses. While the interface may seem a bit outdated, GnuCash is packed with features that can help you manage your finances effectively.

Key Features:

- Double-Entry Accounting: Comprehensive financial tracking.

- Investment Tracking: Manage your portfolio easily.

- Scheduled Transactions: Automate regular payments and deposits.

Compatibility:

GnuCash is compatible with Windows, macOS, Linux, and Android devices.

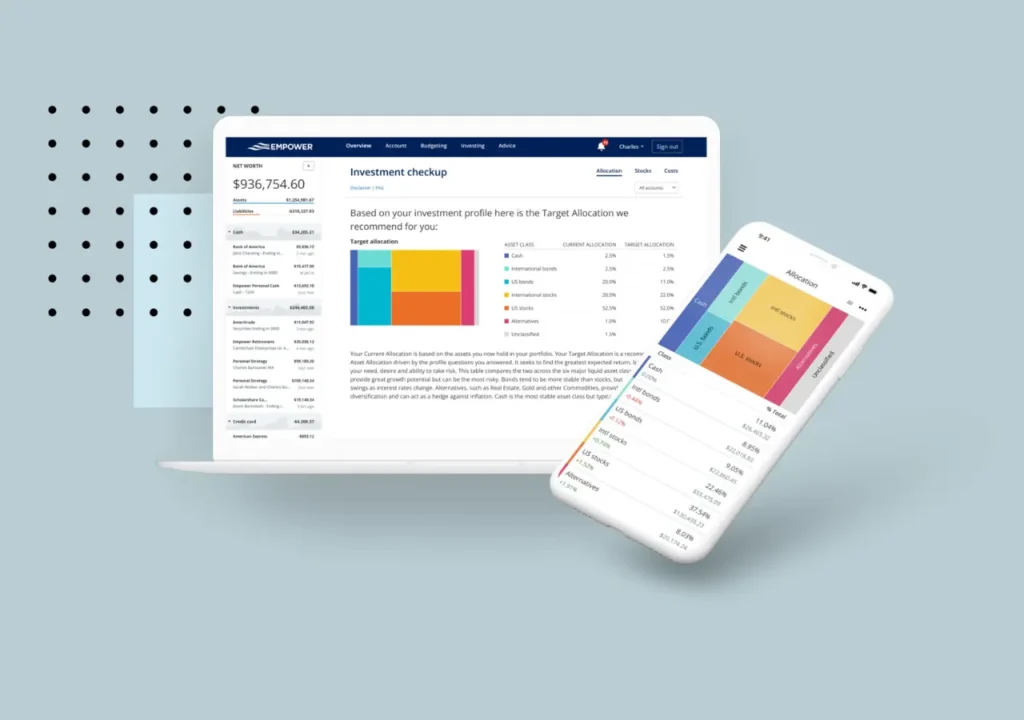

3. Empower

Empower (formerly known as Personal Capital) is a powerful financial planning tool that combines budgeting with investment tracking. Empower’s free version provides comprehensive insights into your financial health by aggregating all your accounts in one place. The software offers detailed investment analysis, retirement planning tools, and a net worth calculator. Empower is especially useful for individuals who want to keep an eye on both their day-to-day finances and long-term investments.

Key Features:

- Investment Analysis: Detailed insights into your investment portfolio.

- Retirement Planning: Tools to help you plan for the future.

- Net Worth Tracking: Monitor your overall financial health.

Compatibility:

Empower is compatible with web browsers, iOS, and Android devices.

4. Buddi

Buddi is a free, open-source personal finance software that is easy to use, making it perfect for those who are new to budgeting. The software is designed to be user-friendly, with features that allow users to track income, expenses, and debt. Buddi also offers budgeting tools to help you plan your finances. Although it lacks some of the advanced features found in other software, Buddi’s simplicity is its strength, particularly for users who prefer a straightforward approach to managing their money.

Key Features:

- Simple Interface: Easy for beginners to use.

- Budgeting Tools: Plan and track your financial goals.

- Multi-Language Support: Available in multiple languages.

Compatibility:

Windows, macOS, Linux

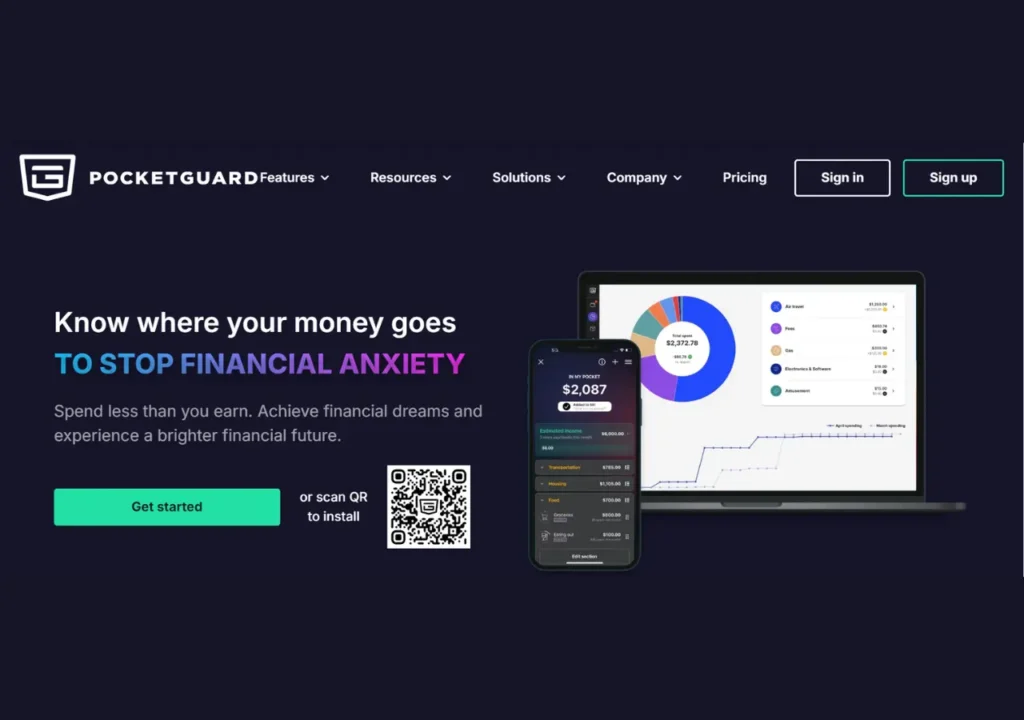

5. PocketGuard

PocketGuard helps users manage their finances by showing them exactly how much disposable income they have after accounting for bills, goals, and necessities. The software automatically categorizes your spending, making it easy to see where your money is going. PocketGuard’s “In My Pocket” feature shows you the amount of money available to spend after considering your expenses. The app also offers budget planning and goal-setting features, making it a comprehensive tool for personal finance management.

Key Features:

- In My Pocket: Clear view of disposable income.

- Automatic Categorization: Easy tracking of spending.

- Goal Setting: Helps you save and manage your finances effectively.

Compatibility:

iOS, Android

6. Quicken

Quicken offers both free and paid versions of its personal finance software. The free version includes basic budgeting tools, expense tracking, and bill management features. Quicken’s interface is user-friendly, and it integrates with your bank accounts to automatically update your financial information. Although the free version lacks some of the advanced features of its paid counterpart, it is still a solid option for users who need basic financial management tools.

Key Features:

- Expense Tracking: Monitor where your money goes.

- Bill Management: Keep track of upcoming bills.

- Budgeting Tools: Create and manage your budget.

Compatibility:

Windows, macOS, iOS, Android

7. HomeBank

HomeBank is another open-source personal finance software that is simple yet effective. It offers tools for tracking expenses, managing budgets, and analyzing your spending patterns. HomeBank supports multiple accounts, currencies, and categories, making it a versatile option for users who need to manage different aspects of their finances. The software’s reports feature allows you to visualize your financial data, helping you make informed decisions.

Key Features:

- Expense Tracking: Keep tabs on your spending.

- Budget Management: Plan and monitor your financial goals.

- Reporting Tools: Visualize your financial data.

Compatibility:

Windows, macOS, Linux

Comparison of Top 10 Free Personal Finance Software: Unlock Your Financial Potential

| Software | Best For | Key Features | Pros | Cons |

|---|---|---|---|---|

| Mint | Comprehensive financial view | Automatic account syncing, budgeting, credit score tracking | Real-time updates, easy to use, secure | Ads may be intrusive |

| GnuCash | Advanced users | Double-entry accounting, investment tracking, scheduled transactions | Flexible, open-source, powerful | Outdated interface |

| AceMoney Lite | Basic financial management | Budget creation, investment tracking, multiple currencies | User-friendly, good for simple budgeting | Limited to two accounts in the free version |

| Empower | Investment tracking | Investment analysis, retirement planning, net worth tracking | Detailed insights, retirement tools | Some features are premium |

| Buddi | Simplicity | Simple interface, budgeting tools, multi-language support | Easy to use, open-source, and great for beginners | Lacks advanced features |

| PocketGuard | Managing disposable income | In My Pocket, automatic categorization, goal setting | A clear view of available funds, intuitive | Limited customization |

| YNAB | Proactive budgeting | Budgeting, educational resources, goal setting | Encourages proactive planning, educational | Subscription required after free trial |

| Quicken | Basic financial tools | Expense tracking, bill management, budgeting tools | Easy to use, integrates with bank accounts | Advanced features require a paid version |

| HomeBank | Expense tracking | Expense tracking, budget management, reporting tools | Open-source, supports multiple accounts | Interface could be improved |

| Personal Capital | Investment and retirement | Investment tracking, retirement planner, budgeting tools | Comprehensive financial dashboard, secure | Some features are premium |

Wrap up:

Free personal finance software offers a range of tools to help you manage your money effectively. Whether you’re looking to create a budget, track your spending, or plan for retirement, there’s a free option available that can meet your needs. By choosing the right software, you can take control of your finances and unlock your financial potential.

FAQS

1. What is the best free personal finance software to Unlock Your Financial Potential?

The best free personal finance software depends on your specific needs. For comprehensive financial management, Mint is highly recommended. If you’re looking for a powerful tool for investment tracking, Empower (formerly Personal Capital) might be the best choice. GnuCash is ideal for those who need advanced accounting features.

2. Can I trust free personal finance software with my financial data?

Yes, most reputable free personal finance software, like Mint and Personal Capital, use bank-level encryption and security measures to protect your data. However, it’s always important to review the privacy policies and security features of any software you choose to use.

3. How does Mint make money if it’s free?

Mint generates revenue through advertisements and product recommendations within the app. While these ads can be intrusive, they allow Mint to offer its services at no cost to users.